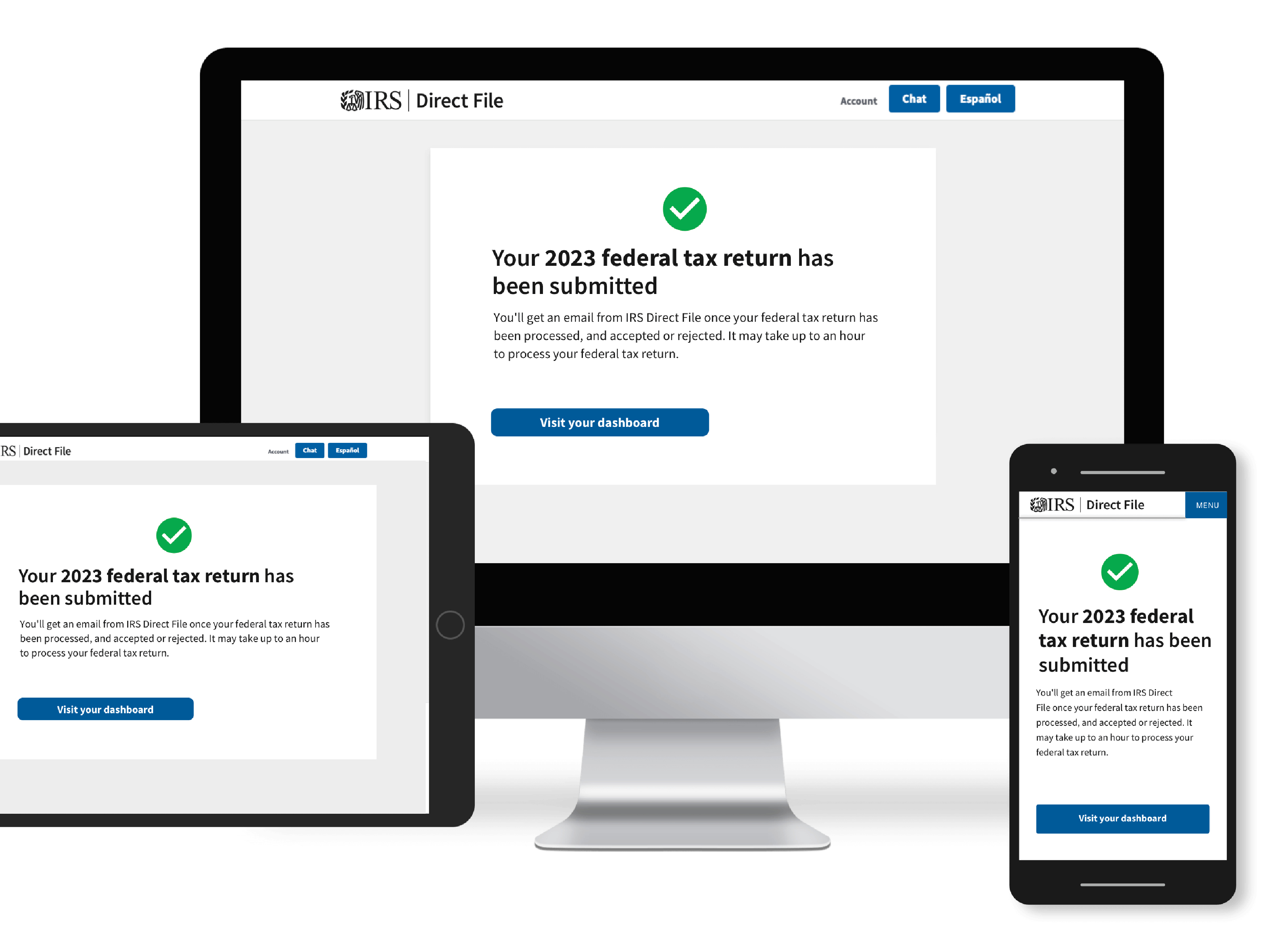

Filing taxes for free with IRS’ Direct File

By the Numbers

tax returns accepted

user research studies conducted

of taxpayers rate their experience “Excellent” or “Above Average”

Net Promoter Score

of users say that their experience with Direct File increased their trust in the IRS

refunds claimed

Challenge

The time people in the United States spend recordkeeping, gathering tax materials, filling out their taxes, and other tax-related activities makes up approximately 63% of all federal paperwork burden annually. Individual taxpayers spend approximately nine hours and $150 preparing their taxes yearly, including all associated forms and schedules for non-business income.

Additionally, many federal aid programs and incentives are distributed through the tax system, such as the Child Tax Credit and Earned Income Tax Credit. However, those programs are often intended to benefit those individuals who struggle the most to interact with the tax system, due to complexity and cost. For example, one in five people eligible for the Earned Income Tax Credit, the largest antipoverty program in the country, does not currently claim the credit. Although taxpayers have various options for preparing their tax returns, there was previously no way for taxpayers to prepare their returns easily, for free, and online directly with the Internal Revenue Service (IRS). These experiences of filing tax returns shape taxpayer expectations, opinions, and perceptions of the IRS.

The launch of Direct File began with a partnership with the U.S. Digital Service(USDS) and expanded to include the General Service Administration (GSA) 18F and two small business vendors. This pilot service, available in 12 states, offered taxpayers a new option to file taxes. The IRS’s involvement in this initiative demonstrates its commitment to improving what otherwise might be a burdensome interaction with many members of the public, and providing taxpayers with more choices in how they interact with the IRS.

Solution

The product and new ways of working

The Inflation Reduction Act directed the IRS to deliver a report to Congress on a potential IRS-run free direct e-file tax return system. Given that many of the largest uncertainties that needed to be addressed in the report were around the implementation of tax scope and user experience, the IRS engaged USDS to approach the report by building a reference implementation/prototype, which would allow direct validation in the real world of the critical questions and would provide a more reliable and realistic evaluation. This prototype was a key input to the Congressional report and evolved into the Direct File product used by 2024 pilot participants.

USDS provided product, engineering, and design leadership to the IRS to start major development of Direct File in June 2023, with a targeted launch date of January 2024. USDS collaborated closely with the IRS, GSA’s 18F, and two small business contractors to create blended teams that with federal employees and contractor engineers and designers working side by side. This blended-teams approach allowed the Direct File team to model new design and agile development methods to the IRS, including having small teams deliver iterative improvements to build the product.

The teams set standards and best practices from the start to make sure that the Direct File pilot would be user-friendly and could be completed within the set timeline. The team focused on the following considerations to ensure that all taxpayers could accurately and confidently complete their taxes.

-

Designed with taxpayers, not for taxpayers. The teams interviewed, observed, and usability tested the service with taxpayers with various attitudes, aptitudes, abilities, and access needs.

-

Uses inclusive design and plain language best practices to help taxpayers understand complicated tax concepts, reduce anxiety, and establish trust.

-

Available in Spanish and has undergone usability testing in Spanish.

-

Accessible, 508 compliant, and user-friendly for taxpayers with disabilities.

Customer support: one team, one dream

Recognizing that a great product alone would not be enough for a system as complicated as tax filing, the USDS worked with the IRS to establish an innovative way of delivering customer support. Live chat was chosen as the primary customer support channel because it allowed support to be integrated directly into Direct File. Taxpayers didn’t have to leave Direct File to seek assistance through another channel, such as the phone. Four hundred trained Customer Support Representatives handled 38,600 taxpayer interactions throughout the filing season.

The customer support and Direct File product teams worked closely throughout the tax filing season to ensure a consistent feedback loop between taxpayers and product improvement. Customer support met daily with the product team to provide feedback and enhance the quality of the product. During the filing season, the team implemented over 1,000 changes to the product, measured via git commits, and deployed new versions at least weekly.

Starting small to get it right

Direct File was gradually introduced to taxpayers over several weeks, starting in January 2024. This approach allowed the team to thoroughly test the new service and continuously improve the taxpayer experience before making it available to larger audiences. By prioritizing execution certainty in the rollout approach and limiting the scope in the pilot year, Direct File maintained its reliability as a service throughout the filing season.

By delivering this solution from design to product and customer support operations, USDS and the IRS partnered to improve government service, setting the stage for drastically improving the tax filing experience.

If you can make Direct File available to ALL Americans in all 50 states and all territories that would help the American people and our economy.

Impact

Over 140,000 people in the 12 pilot states filed their taxes for free directly with the IRS and received over $90 million in federal tax refunds. Those federal tax refunds provided access to the Earned Income Tax Credit and Child Tax Credit, two of the country’s largest and most effective antipoverty and anti-child-poverty programs.

In addition to refunding taxpayers, Direct File indirectly increased public trust in the government. At a time when public trust in government is at a historic low, 86% of Direct File users who filed their taxes and completed a post-submission survey said their experience with Direct File “increased their trust in the IRS.” Ninety percent of those users rated their experience with Direct File as “Excellent” or “Above average.” One survey respondent said they “love being able to do my taxes on my own, on my own time, feeling trusted, guided, and protected since using this form. Thank you!”

Que lo hice en español. Sí hablo inglés, pero prefiero español para estar más seguro que lo estoy haciendo bien.” (That I did it in Spanish. I do speak English, but I prefer Spanish to be more confident that I am doing it right.)

Within the IRS, the Direct File team’s approach to design, blended teams, and agile development methods has begun to draw the attention of other departments that are also actively engaged in improving other IRS products and services and inspired to evolve their practices. Commissioner Werfel attributed agile methodology as the key to a favorable delivery when asked how the IRS successfully deployed Direct File. USDS will continue to partner with its IRS IT partners to expand agile development further at the agency.

Ultimately, and this is a little geeky… it was agile technology that was the eye-opener. There’s a whole discipline around how you move more quickly to deliver incremental functionality, strip through bureaucracy to make decisions more quickly and take calculated risks more regularly. Here, by sizing this [Direct File release] in an increment that had an impact, we could be more agile, have exceptional certainty, and launch something we can all learn from.

Press

More projects

-

Internal Revenue Service

Internal Revenue ServiceFiling taxes for free with IRS’ Direct File

USDS partnered with the IRS to deliver the IRS Direct File Pilot, a free way for eligible people to file their taxes for free, directly with the IRS.

-

Social Security Administration

Social Security AdministrationContinuously improving SSA.gov

The Social Security Administration is building on the momentum from their partnership with the U.S. Digital Service by implementing iterative research, best practices, and a data-informed approach to ensure the website is usable and useful.

-

Centers for Disease Control and Prevention

Centers for Disease Control and PreventionPreparing for the next pandemic while building tech for COVID-19

We worked with the Centers for Disease Control and Prevention to quickly create and scale technology programs that digitize and share infectious disease test results in real-time.

-

Health and Human Services

Health and Human ServicesModernizing the child care application process

USDS partnered with ACF’s policy and subject matter experts to create a Model Child Care Assistance Application and eligibility verification practices that met federal guidelines and demonstrated the “art of what’s possible.

-

Cross-agency

Cross-agencyOptimizing benefits for families

Working alongside The Department of Treasury and the White House, we built ChildTaxCredit.gov to educate families about the expanded Earned Income Credit and Child Tax Credit. The USDS team relied on in-depth research to create a site that is accessible, easy-to-read, and provides resources to find free tax services.

-

Cross-agency

Cross-agencyChanging how the government hires technical talent

We helped develop a process that allows HR to leverage subject matter experts to evaluate candidates for specialized roles. The result restores fair and open access for all applicants, shortens the hiring timeline, and ensures applicants are truly qualified.

-

Veterans Affairs

Veterans AffairsSimplifying Veteran‑facing services through VA.gov

Each month, over 10 million people attempt to access the digital tools and content at the Department of Veterans Affairs (VA) and have historically struggled to find what they’re looking for. Digital modernization efforts needed to focus on improving the user experience.